What is PII?

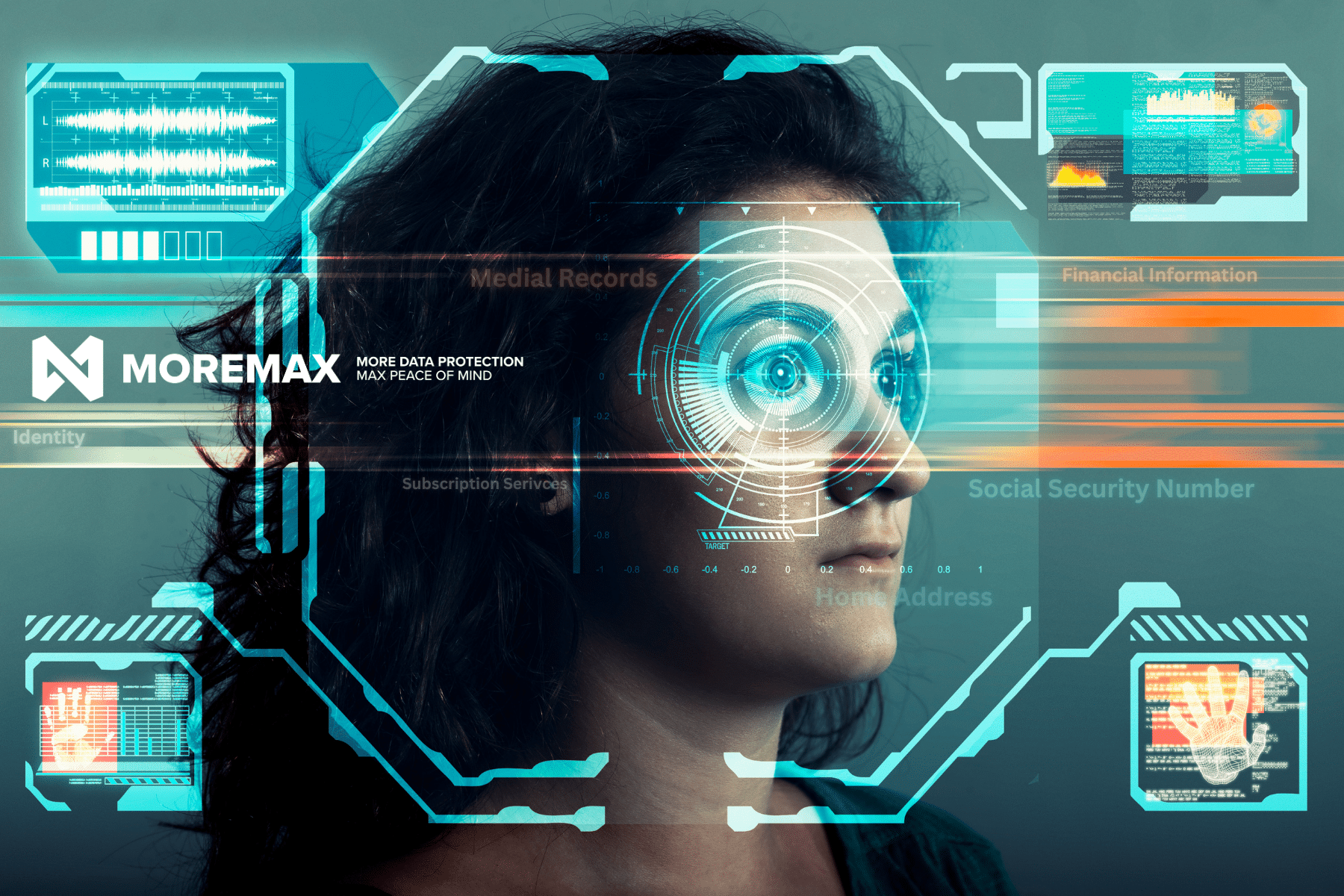

Personally Identifiable Information, or PII, is any data that can be used to identify a specific person. This could be your name, address, phone number, email, social security number, or even your online browsing history. In the wrong hands, this information can be used to cause you significant trouble. Cybercriminals are always on the lookout for PII because it’s like a golden ticket that grants them access to your life. But why is this information so valuable, and what happens when it gets stolen?

The Hidden Market for Your Personal Data

Think of your personal information as a valuable item, like a piece of jewelry. Just like thieves target jewelry, cybercriminals target your personal information. On the dark web—a hidden part of the internet where illegal activities take place—your PII is bought and sold by criminals.

The price of PII on the dark web varies depending on what’s being sold. Basic information like your email address might go for just a few cents. But if a hacker has a full package of information about you—called a “fullz,” which could include your name, address, social security number, and bank account details—that could sell for hundreds of dollars. This information can then be used to steal your identity, open credit accounts in your name, or sell to others who want to commit fraud.

How Cybercriminals Steal Your PII

So, how do cybercriminals get their hands on your PII? Here are a few common methods:

-

- Phishing Scams: These are fake emails or messages designed to trick you into giving away your personal information. They might look like they’re from your bank or a trusted company, but they’re actually just clever traps.

-

- Data Breaches: When a company gets hacked, the personal information they have stored about their customers, like you, can be stolen. Hackers then sell this data on the dark web.

-

- Social Engineering: This is when a criminal tricks you into giving them information by pretending to be someone you trust, like a customer service agent or a government official.

-

- Malware: Hackers use malicious software to break into your devices, steal your information, and even take control of your systems.

-

- Public Wi-Fi Eavesdropping: If you use an unsecured public Wi-Fi network, cybercriminals can intercept the data you send and receive, including sensitive information like passwords and credit card numbers.

What Happens When Your PII Gets Stolen?

Having your PII stolen can have serious consequences, both emotionally and financially. Imagine waking up one day to find that someone has emptied your bank account, opened new credit cards in your name, or taken out loans that you didn’t apply for. This isn’t just a bad dream—it’s a nightmare that many people have lived through. The stress and anxiety of dealing with identity theft can be overwhelming.

Financially, the impact can be devastating. Fixing the damage caused by identity theft can take months or even years. You might face legal issues, problems with your credit score, and the ongoing stress of trying to prove your identity and clear your name. Some victims never fully recover from the financial and emotional toll.

What Do Cybercriminals Do with Your PII?

Once cybercriminals have your PII, they can use it in several ways:

-

- Identity Theft: This is when criminals use your information to pretend to be you. They might open bank accounts, apply for credit cards, or take out loans in your name.

-

- Financial Fraud: If criminals have your banking information, they can make unauthorized transactions and drain your accounts.

-

- Blackmail and Extortion: Sometimes, cybercriminals will use sensitive information to threaten or blackmail victims, demanding money in exchange for not releasing the information.

-

- Synthetic Identity Fraud: Criminals can mix your real information with fake details to create a new identity. They can then use this fake identity to open accounts and commit fraud.

-

- Account Takeovers: Using your PII, criminals might try to log in to your accounts, especially if you use the same password on multiple sites. Once they have access, they can lock you out and take over.

Why Do Cybercriminals Want Your PII?

PII is valuable because it can be used in so many ways. A single piece of information, like a social security number, can unlock multiple opportunities for fraud. Also, unlike passwords, you can’t easily change your PII. Your name, date of birth, or social security number stays the same forever, making it permanently valuable to criminals.

Moreover, with so much of our lives now online, there’s more PII out there than ever before. Every time you shop, bank, or even just browse the internet, you’re sharing bits of your personal information. This makes it easier for cybercriminals to find and steal your data.

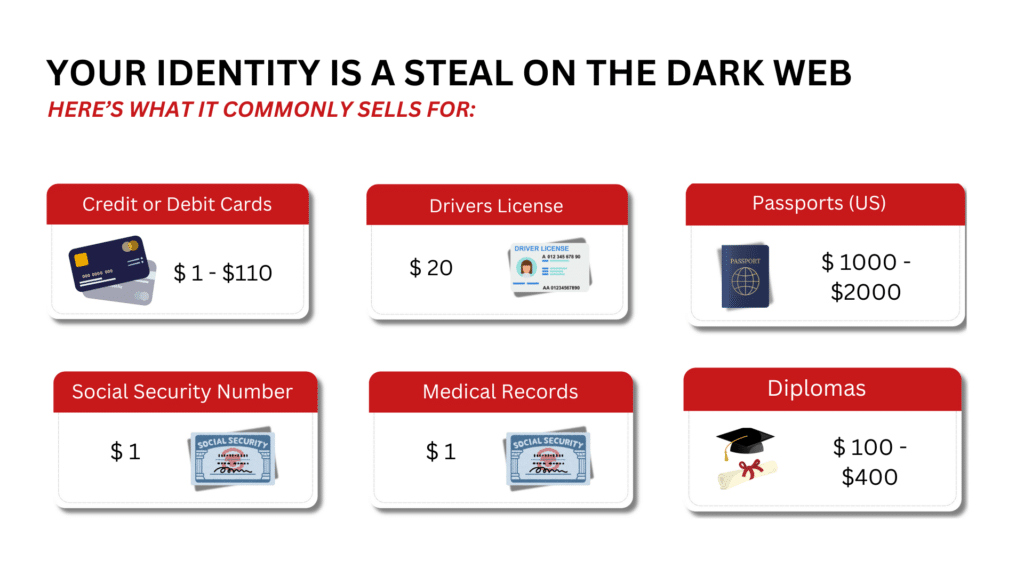

How Much is Your PII Worth?

On the dark web, different types of PII sell for different prices. Here’s a rough idea of what your personal data might be worth:

-

- Credit Card Information: $5 to $110, depending on the card type and credit limit.

-

- Fullz (Full Identity Pack): $30 to $100 or more, especially for people with good credit.

-

- Social Security Number: $1 to $5, but this increases when combined with other information.

-

- Online Banking Details: $50 to $1,000, depending on the account balance.

-

- Driver’s License: $20 to $80, particularly when sold with other personal details.

These prices change based on how easy or hard it is to get the information and how much demand there is for it.

How to Protect Your PII

Protecting your PII is essential. Here are some steps you can take right now:

-

- Use Strong, Unique Passwords: Make sure your passwords are strong and unique. Use a mix of letters, numbers, and symbols, and avoid using the same password for different sites.

-

- Turn on Two-Factor Authentication (2FA): This adds another layer of security by requiring a second form of verification, like a code sent to your phone.

-

- Be Wary of Phishing Scams: Don’t click on suspicious links or provide personal information in response to unsolicited emails or messages.

-

- Monitor Your Financial Accounts Regularly: Keep a close eye on your bank and credit card statements for any unusual activity.

-

- Install Antivirus and Anti-Malware Software: Protect your devices with software that can detect and prevent malware.

-

- Be Careful About What You Share Online: The less personal information you share, the less there is for cybercriminals to steal.

-

- Stay Informed: Cybercriminals are always coming up with new tricks. Stay updated on the latest threats and learn how to protect yourself.

Conclusion: Protect Your Information

Protecting your PII is a personal responsibility that each of us, especially if you are a lawyer who works with your client’s PII, must take seriously. Cybercriminals are always looking for new ways to steal our information, and the consequences can be severe. By being aware of the risks and taking steps to safeguard your information, you can reduce your chances of becoming a victim. Remember, your personal information is one of your most valuable assets, treat it with care.